READY TO GO SOLAR PACKAGES

All of the products supplied by us are manufactured within the stringent engineering guidelines. They are ALL approved by the Clean Energy Council ensuring that all products meet certified Australian Standards and are backed by New Sky Energy Solutions manufacturers warranties.

5KW TO 30KW OPTIONS AVAILABLE

Pricing can vary based on the following factors:

-

Tin or tile roof

-

Single or double storey

-

ZONE 3 S.T.C or ZONE 2 STC discount

-

Solar Victoria rebate and interest-free loan eligibility criteria apply

-

Prices include GST

-

These prices are only while rebates last

-

Single-phase or 3-phase supply

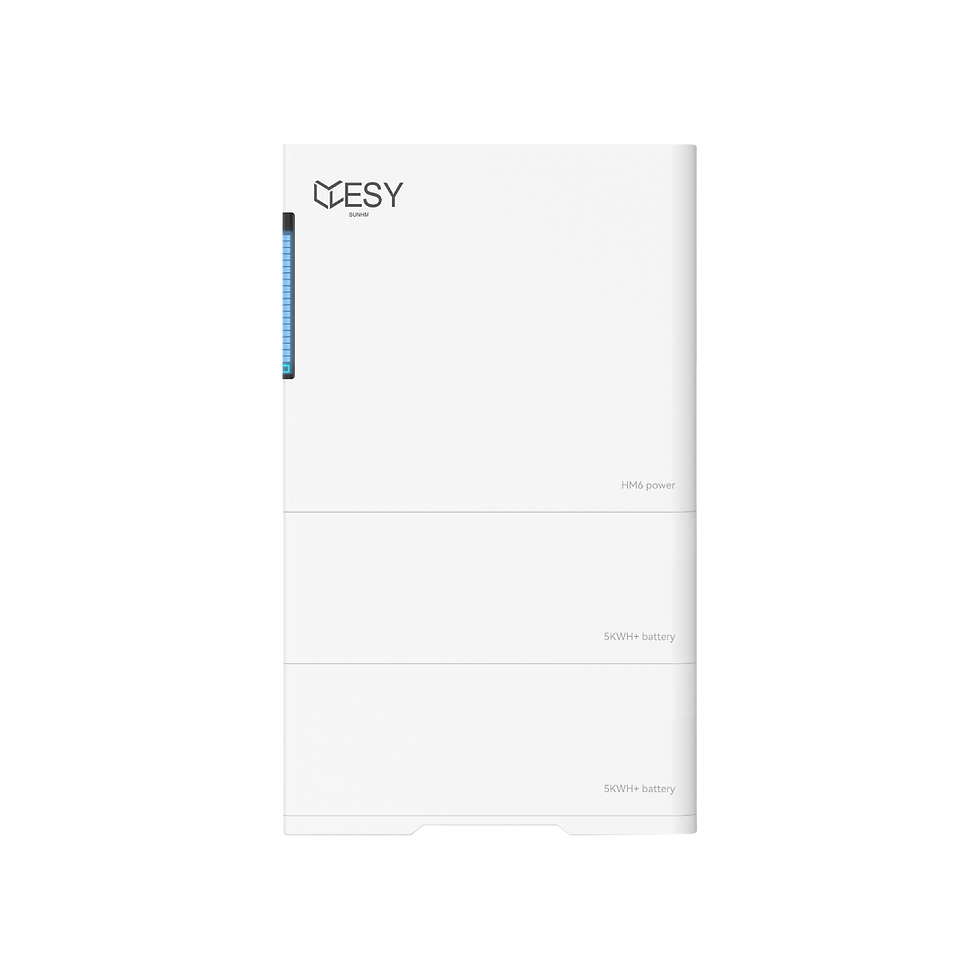

Explore Inverter & Battery Packages

Looking to add battery storage to your home or upgrade your solar setup?

At New Sky Energy Solutions, we make it easy. Our inverter and battery bundles include trusted brands, professional installation, and upfront pricing with rebates applied.

✔ Quality Inverters & Scalable Battery Options

✔ Simple Online Booking - Pick Your Install Date

FREQUENTLY ASKED QUESTIONS

Haven’t found what you’re looking for? Feel free to chat with our team or contact us directly on 1300 375 849